How much can i borrow mortgage salary

Also you may want to see if you have one of the 50 best jobs in America. Mortgage rates are determined by your lender and can be fixed or adjustable.

A Home Of Your Own Home Buying Living Room Accessories Living Room Theaters

Bank statement for the last year in which the salary is paid.

. Fill in the entry fields and click on the View Report button to see a complete amortization schedule of the mortgage payments Bankrate. Should you require any additional information please do not hesitate to contact Human Resources on 02 0000 0000. Your salary will have a big impact on the amount you can borrow for a mortgage.

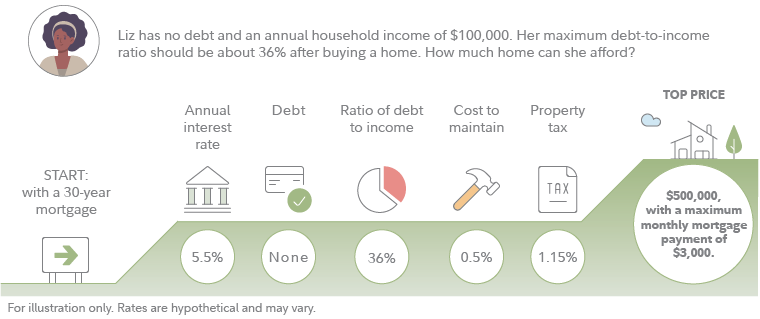

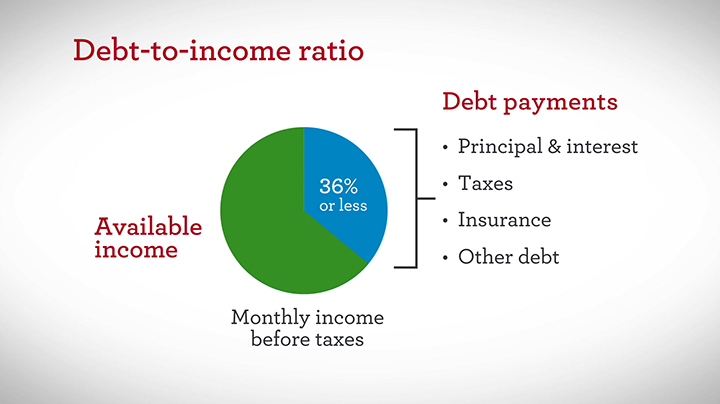

You can use the above calculator to estimate how much you can borrow based on your salary. How much extra can I borrow. To calculate u2018how much house can I affordu2019 a good rule of thumb is using the 2836 rule which states that you shouldnu2019t spend more than 28 of your gross monthly income on.

Our Buying a home timeline sets out how long you can expect the process of buying a home to take and what the various steps are. If you already have a mortgage with us you can take your first direct mortgage with you when you move house known as. You can also input your spouses income if you intend to obtain a joint application for the mortgage.

Find out what you can borrow. Along with the down payment this is probably one of the two biggest factors that determine how much you can afford. Use our guide to work out how much youll need to pay.

Total subsidized and unsubsidized loan limits over the course of your entire education include. If youre hoping to take out a mortgage our borrowing calculator will give you a rough idea of how much a lender might offer you based on how much you earn and whether youre buying with anyone else. His salary is 80000 per annum gross.

Or 4 times your joint income if youre applying for a mortgage. Mortgage rate refers to the interest rate on your mortgage. Fee-free valuation Fee Saver mortgages available too mortgage terms up to 40 years.

Basic salary including any employed allowances such as car allowances London weighting net profit if. Purchasing a home is a decision that will impact your financial situation for the next 15 to 30 years. 31000 23000 subsidized 7000 unsubsidized Independent.

Our How much can I borrow. Mortgage advisers available 7 days a week. 51 How much can the bank lend you for your mortgage.

Your salary bill payments any additional outgoing payments including examples such as student loans or credit card bills. Remortgaging How to decide when and how to remortgage. Factors that impact affordability.

When arranging mortgages we need to satisfy lenders that can comfortably afford the repayments on the mortgage. Residents can generally borrow up to 80 of the propertys assessed value whereas non-residents are limited to 6070 LTV. While your personal savings goals or spending habits can impact your.

Second time buyers can take out a mortgage of up to 80. The type of mortgage you choose can have a dramatic impact on the amount of house you can afford especially if you have limited savings. Why salary deposit affects how big a mortgage you can get.

FHA loans generally require lower down payments as low as 35 of the home value while other loan types can require up to 20 of the home value as a minimum down payment. Convert my salary to an equivalent hourly wage. Let us know a bit about your mortgage and your spending to see what extra we may be able to lend you on your mortgage.

You could get an agreement in principle that lasts 6 months sorted in a 30-minute phone call. When it comes to calculating affordability your income debts and down payment are primary factors. How much can I afford to borrow.

He is not on probation. 5 FAQs on Getting a Mortgage in Spain. 55x your salary if you earn 75K or 100K on a joint application if youve got a 15 deposit to borrow up to 2M How many times my salary can I borrow The idea that mortgage lenders use a secret salary-multiplier formula is that UK borrowers are reluctant to let go.

Use this calculator to determine what your hourly wage equates to when given your annual salary - it may surprise you what you make on an hourly basis. Its important to calculate your monthly income and expenses carefully to avoid winding up with a mortgage loan you cant pay in the long run. Your lender typically requires two years of W2s and current pay stubs to verify income.

Usually banks and. How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment. Even though income hasnt been the key lending criteria for banks.

His net salary is 60760 per annum only some lenders require the net salary. Lets presume you and your spouse have a combined total annual salary of 102200. You may also want to convert an hourly wage to a salary.

He started working with us on 112015. Someone on a single income of 90000 can borrow 85000 less for a home loan than they could a year ago and a couple with a 200000 combined salary can borrow a quarter of a million dollars less. He is employed on a permanent full time basis.

How much do you think youll be able to borrow from the bank. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan.

Stable and reliable generally includes sources such as your salary spouses salary pensionretirement part-time income and bonuses if they are reliable and anticipated to continue. These factors are taken into consideration when a mortgage lender calculates how much they could ideally lend you for a mortgage. How much can I borrow.

This means they can stay the same or change over the life of the loan. Guide gives you an indication of what youre likely to get based on salary and outgoings. This mortgage calculator will show how much you can afford.

Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any. The amount you can borrow for your mortgage depends on a number of factors these include. First time buyers can take out a mortgage of up to 90 of the purchase price of a home.

How much home can I afford.

A Big Part Of Financial Freedom Is Having Your Heart And Mind Free From Worry Away From What Ifs Of Life Rupeerede Borrow Money Personal Loans The Borrowers

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

How I Got A Credit Score Over 800 And You Can Too Future Expat Credit Repair Business Credit Repair Credit Repair Services

How Much House Can I Afford Fidelity

How Much House Can I Afford Bhhs Fox Roach

How Much House Can I Afford Calculator Money

Gross Salary Vs Net Salary Top 6 Differences With Infographics Salary Project Finance Business Valuation

Get Fast And Quick Cash Loan Online In India From Payme India In 2022 Cash Loans Cash Loans Online No Credit Loans

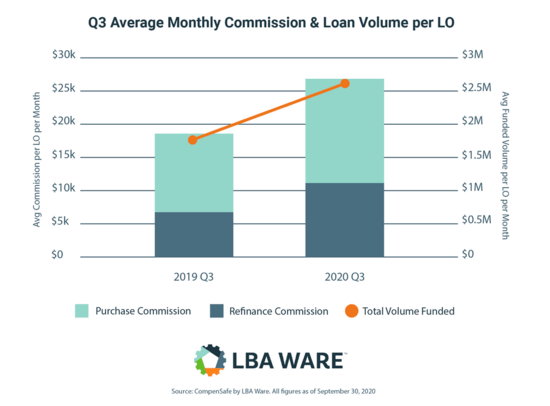

Loan Officer Job Description Expected Salary And What Your Day Will Look Like

Pin On Personal Loan

Pin By Land Loan Specialists On Oklahoma Land Loan Land Loan Farm Loan Farm

Mortgage How Much Can You Borrow Wells Fargo

12 Step Guide To Getting Your Finances In Order Learn To Negotiate Salary Bills And Everything Else Personal Finance Books Money Advice Finance

I Prepared A New Worksheet To Make Students Talk About The Topic Of Money English Conversation Learning Speaking Activities English English Language Teaching

How Much Should I Save For Retirement At My Age Prudential Financial Life And Health Insurance Saving For Retirement Health Insurance Policies

How Student Debt Makes Buying A Home Harder And What You Can Do About It Student Loan Payment Mortgage Approval Student Loan Debt

Mortgage Math Directions Chart