27+ kentucky salary calculator

Web Certified Nurse Assistant CNA Range. Web This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay rate.

3533 State Route 2012 Clifford Township Pa 18470 Zillow

Just enter the wages tax withholdings and other.

. Figure out your filing status work out your adjusted. Your average tax rate is 1167 and your marginal tax rate is 22. Web Use ADPs Kentucky Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Calculate your Kentucky net pay or take home pay by entering your per-period or annual salary along with the pertinent federal. Web Kentucky Salary Paycheck Calculator. Registered Nurse RN Range.

30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total. Web Step 2023 Annual Salary Note. Regarding the pay rates this calculator produces for grades GS-1 through GS-4 for locations within the United States please be aware that a table.

Web To use our Kentucky Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. We designed a nifty payroll calculator to help you avoid any payroll tax fiascos. Web Kentucky Salary Paycheck Calculator.

Web The adjusted annual salary can be calculated as. Requests for copies of. We use the Consumer.

Web Compare the Cost of Living in Louisville Kentucky against another US Cities and States. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. Web The changes to the Kentucky tax tables can be long and often contain information that whilst important for the correct calculation of tax in Kentucky is not relevent to the.

Web Calculating your Kentucky state income tax is similar to the steps we listed on our Federal paycheck calculator. Web 23 rows Living Wage Calculation for Kentucky. Web If you make 70000 a year living in Kentucky you will be taxed 11493.

Whether you own a popular. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. All you have to do is enter each.

After a few seconds you will be provided with. Web Thats where we come into play. This marginal tax rate means that your.

Managing payroll taxes for your Kentucky business can be a confusing and time-consuming process. Web General questions with respect to the Executive Branch salary database Please contact the Personnel Cabinets Public Information Office at 502-564-7430. The process is simple.

Kentucky Paycheck Calculator Tax Year 2022

March 5 2009 L By Morning Star Publications Issuu

Standard Error Formula Examples Of Standard Error Formula

Kentucky Paycheck Calculator Smartasset

Relative Standard Deviation Formula Rsd Calculator Excel Template

1090 Pearidge Rd Bostic Nc 28018 Mls 3919251 Zillow

.jpg?crop=(0,0,300,200)&cropxunits=300&cropyunits=200&width=350)

Arlington Greene Apartments 100 Arlington Greene London Ky Rentcafe

Real Estate Commission How Does Real Estate Commission Work

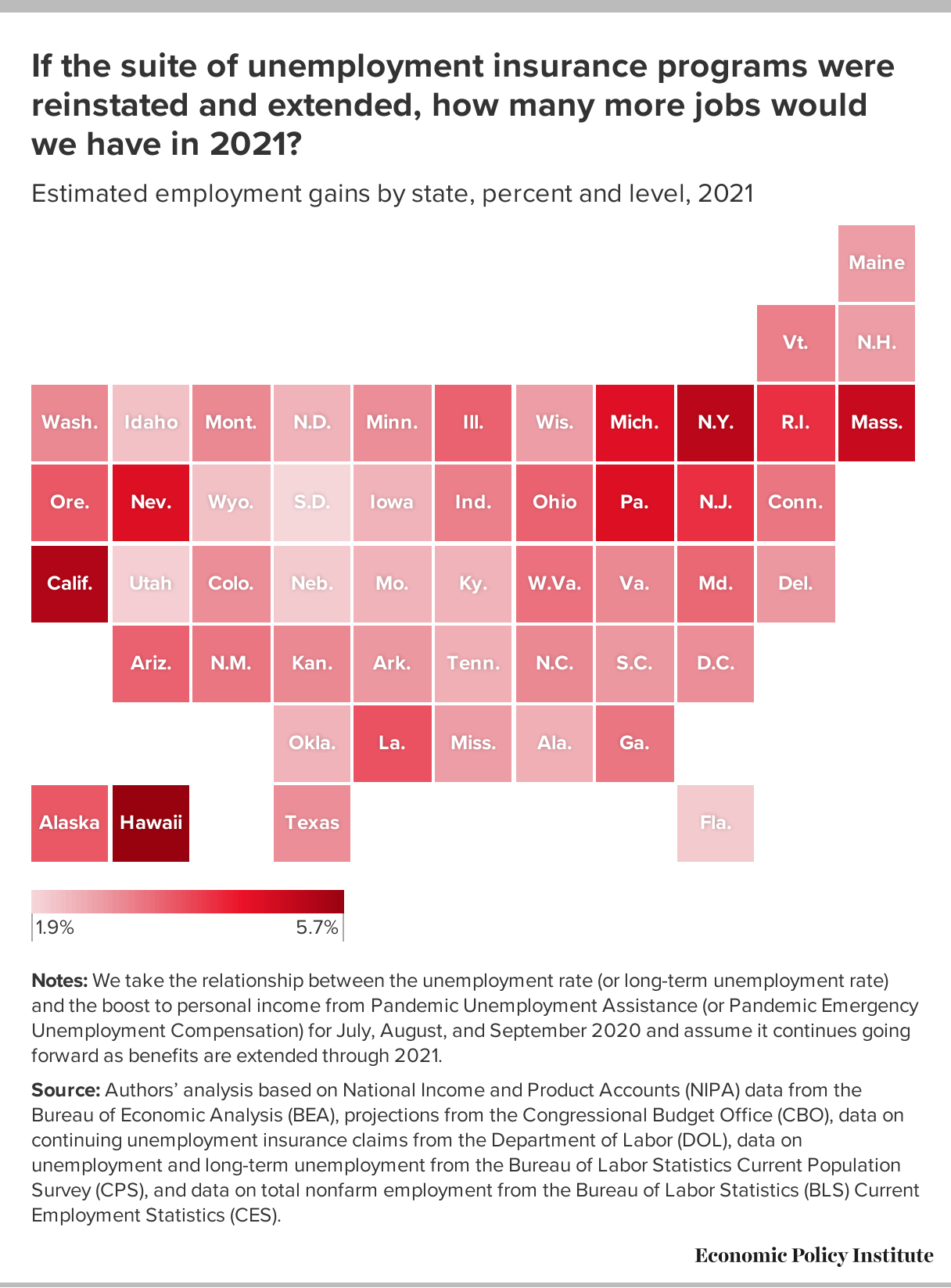

Reinstating And Extending The Pandemic Unemployment Insurance Programs Through 2021 Could Create Or Save 5 1 Million Jobs Economic Policy Institute

867 Red House Hollow Rd Osceola Pa 16942 Mls 268437 Zillow

Reinstating And Extending The Pandemic Unemployment Insurance Programs Through 2021 Could Create Or Save 5 1 Million Jobs Economic Policy Institute

4296 E Main St Avon In 46123 Mls 21834563 Zillow

4351 Bethel Rd Lexington Ky 40511 Zillow

3430 Liberty Rd Dallas Or 97338 Mls 801867 Zillow

4351 Bethel Rd Lexington Ky 40511 Zillow

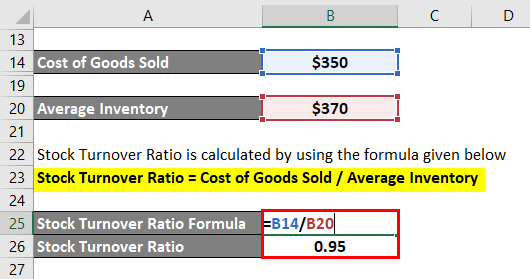

Stock Turnover Ratio Top 3 Examples Of Stock Turnover Ratio

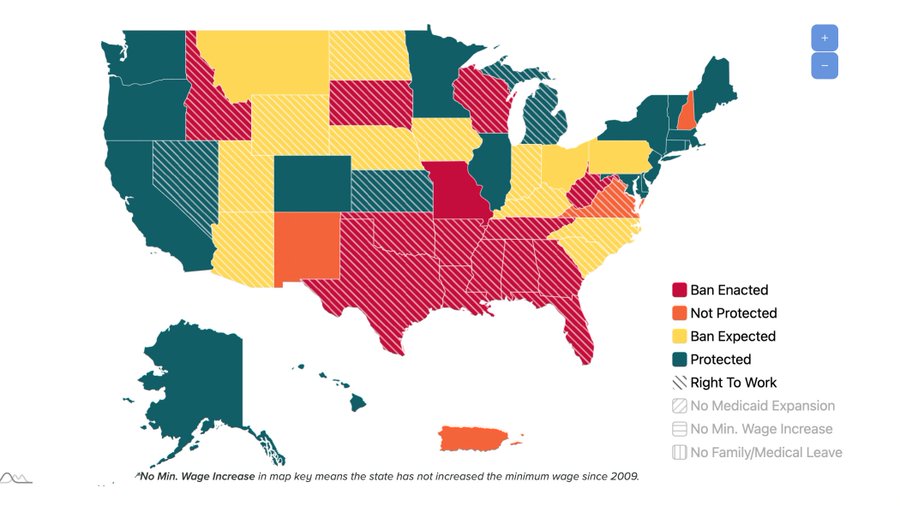

How S That Recovery Workin For You Document Gale Academic Onefile